MANILA, Philippines – Retail giant Puregold Price Club launched Tindahan ni Aling Puring’s first KAINdustriya Convention last Oct. 14 at the World Trade Center in Pasay City in recognition of the contribution of local food businesses in driving the economy. In photo (from left) are RJ Ledesma, Mercato Centrale; Larry Conchangco, executive vice president for sales, Fly Ace Corporation; Angie Flaminiano, president and COO, Nutri-Asia Inc.; Shankar Viswanathan, general manager, Procter & Gamble Philippines; Vincent Co, merchandising director, Puregold; Susan Co, vice chairman, Puregold; Lucio Co, chairman, Puregold; Leonardo Dayao, president, Puregold; Antonio De Los Santos, national operations manager, Puregold; Colin Butler, managing director, Unilever Food Solutions; Raul Nazareno, president, Branded Business Cluster, San Miguel Purefoods Co.; John Martin Miller, chairman and CEO, Nestle Phils. Inc.; and Ashish Pisharodi, country manager, Mondelez Philippines Inc.

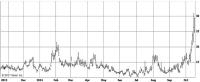

The last three weeks have proven to be one of the most volatile and painful times for stock investors. European indices from Germany to Italy were gripped with fear, losing more than 10 percent over this time period. By the 2nd week of October, the Dow Jones had wiped out its entire return for 2014. Even the Philippines was not spared, with the index falling as much as 3.8 percent for the week and breaking the crucial 7,000 level before recovering. Global slowdown The proximate cause behind the weakness in equities is the slowdown in global growth. In our previous presentations, we highlighted the ISIS conflict and the Russia-Ukraine crisis as key geopolitical risks that may affect global growth if left unabated. We said then that if sanctions against and from Russia escalate, then it is not only Europe’s growth that will be affected, but the rest of the world as well. Unfortunately, these fears did come to pass. ISIS continues to wreak havoc with thousands of people murdered, while Russia, Western Europe and the US remain in a cold war. Too strong a dollar not welcome Two weeks ago, we wrote about the strong dollar and its impact on different currencies (see It’s the strong dollar, stupid! Part II, Oct. 20, 2014). Commodity-exporting countries continue to suffer as their exports drop in value. Many other countries have voiced their apprehension over the sharp strengthening of the world’s reserve currency. Even the US has aired its concern over the strong Read More …

MANILA, Philippines – The Bangko Sentral ng Pilipinas represented by Deputy Governor Diwa C. Guinigundo (left) and the Department of Foreign Affairs led by Undersecretary Linglingay F. Lacanlale (second from right) signed a memorandum of understanding to help overseas Filipinos, who are hastily repatriated from foreign countries due to significant security risks or armed conflict, exchange their foreign currency to Philippine pesos. Other signatories were BSP director of the international operations department Patria B. Angeles and DFA Assistant Secretary Domingo P. Nolasco. The MOU expedites the process of setting up currency exchange facilities (CEFs) that allows returning OFWs with foreign currencies that are not readily convertible to have them exchanged at the BSP head office, its regional offices and branches nationwide, and at authorized agent banks. So far, the seven CEFs that have been established have allowed repatriated Filipinos to exchange over P200 million worth of foreign currencies. The CEF for overseas workers from Libya is now activated and is available until Dec. 9, 2014.

MANILA, Philippines – The National Grid Corp. of the Philippines (NGCP) has recently energized the 230-kilovolt line connecting the northern and southern Mindanao. The 213-circuit kilometer-long line from Villanueva, Misamis Oriental to Maramag, Bukidnon is part of the second stage of the new Mindanao transmission Backbone Project, NGCP said. The high voltage transmission project, known locally as the Kirahon-Maramag 230-kv line provides a vital link between northern Mindanao where most power plants exist and southern Mindanao where the load or demand is expected to go up on more economic activities. With an estimated project cost of P988 million, the Kirahon-Maramag line traverses two provinces and eight municipalities. NGCP president and CEO Henry Sy, Jr. said the southern part of Mindanao, particularly the SOCSARGEN area and Davao, is the load center of the island since it is also the center for commerce Thus, he said NGCP needs to ensure that the power generated from the north is transmitted reliably to SOCSARGEN and Davao, especially during the summer season. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 “The Kirahon-Maramag line and the new Mindanao Transmission Backbone will ensure that the supply is fully dispatched to meet the demand in the south,” he said. In all, the Mindanao Backbone Project intends to increase NGCP’s transmission capacity in Mindanao to 230 kv from 138 kv. It is seen to boost the transmission of power supply from the Agus and Pulangi hydro facilities, the main source of power in the island. According to NGCP, Read More …

MANILA, Philippines – The Philippine Stock Exchange (PSE) is not giving Alphaland Corp.’s delisting a second look despite the latter’s appeal. In a new circular, PSE president and chief executive officer Hans Sicat has ordered for Alphaland’s shares to be removed from the official registry of the exchange. Alphaland chief executive officer Roberto V. Ongpin earlier made an appeal to the PSE to reconsider its decision to delist the upscale property developer from the local bourse. Ongpin claimed that the PSE’s decision is not final and executory and is still subject to the appeal process. In early September, the PSE came out with a decision to kick out Alphaland from its roster of listed companies to serve as penalty for violating disclosure requirements. On top of the delisting punishment, Alphaland has also been banned to apply for relisting within five years after its delisting date. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 Ongpin, however, has said that if the PSE does not reconsider its petition, Alphaland will appeal to the Securities and Exchange Commission and even move it up to the Supreme Court if necessary. Alphaland last week concluded a tender offer in which it was able to acquire 2.67 million shares from non-strategic shareholders. A tender offer has been required by the local stock market operator as part of the delisting order in consideration of the minority shareholders of Alphaland as well as “for the maintenance of a fair and orderly market.”

MANILA, Philippines – The Securities and Exchange Commission has given its go-signal for the P15-billion preferred shares offering of Ayala Corp., the country’s oldest conglomerate. AC is now cleared to offer up to 30 million preferred Class B shares at P500 apiece. The conglomerate plans to use proceeds of the offering solely to refinance certain peso denominated obligations amounting to P12.95 billion. The debt obligations include bank loans to BDO (P10 billion), Metrobank (P1.46 billion), and corporate notes from various lenders that include The Philippine American Life and General Insurance Co., Philplans First Inc., Philam Bond Fund Inc., and Government Service Insurance System (P1.49 billion). AC said in its filing that the new series of Class B shares would be offered with a fixed quarterly dividend rate and are structured as perpetual equity securities that have preference in the payment of dividends. BPI Capital Corp has been tapped as the issue manager for the sale of Class B shares which shall be listed on the Philippine Stock Exchange. Business ( Article MRec ), pagematch: 1, sectionmatch: 1

MANILA, Philippines – Central Azucarera de Tarlac Inc (CAT) has acquired shares in the company that owns Luisita Industrial Park in Tarlac. In a disclosure to the local bourse, CAT said it has purchased 349,900 shares of stocks in Luisita Realty Corp. for P135 million. Luisita Realty has recently been found compliant by the Department of Labor and Employment (DOLE) and was issued a Certificate of Compliance on General Labor Standards (GLS) and Occupational Safety and Health Standards (OSHS). The Luisita Industrial Park, which Luisita Realty owns, earlier this month became the first labor laws-compliant economic zone in the country. It currently has nine locator-firms that employ a total of 9,167 workers. CAT Resource & Asset Holdings Inc (CRAHI) recently became the new controlling shareholders of CAT after it purchased for P1.80 billion a total of 69.98 percent stake sold by previous controlling shareholders of the listed sugar company. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 CRAHI intends to develop a 330-hectare industrial land of CAT and engage in the real estate business as an additional business. The new controlling shareholders of CAT also want the listed sugar firm to acquire additional industrial/residential land around its current industrial land.

Many people are employed, but not engaged. There is a huge difference between employees who are merely present from those who are engaged and truly dedicated. If you look back in business history, engagement was not necessary during the period of industrialized economy. It was optional during the time of knowledge economy. But today in our creative economy, it is the main game. The challenge with engagement is that it’s a gift, not an exercise of control. Nobody could be inspired to become more engaged in their jobs by memorandum. A leading poll firm in the United States of America claims that only 20 percent of local workers are fully engaged. This means tremendous losses in the work place. Many HR practitioners want more engagement in their work environment and would often turn to persons capable of motivating their employees. But then, this makes me think. What causes the low rate of engagement? Business ( Article MRec ), pagematch: 1, sectionmatch: 1 Is it the amount of work? No, I don’t think so. Some people might say it is because of poor work environment. No, not necessarily. I have been to companies that showcase very beautiful, modern work facilities yet their attrition rate is still very high. Now, not many people are willing to admit this for fear of losing clients. But if a consultant’s motive is to help the clients improve, then the truth must be spoken no matter how politically incorrect it may sound. One of the top Read More …

MANILA, Philippines – Manila Mayor Joseph E. Estrada has expressed full support for the restoration and development of the historic Manila Army and Navy Club amidst the spat of controversies hounding the project. “The restoration is a matter of extreme necessity. Otherwise, the historic landmark will continue to rot and decay. It is a good thing that some civic-spirited groups and businessmen have pledged support,” Estrada said. Estrada explained that once restored, the club would again be a historical landmark of the country and would provide opportunities for gainful business and employment. For nearly 30 years, the Army and Navy Club has been an accident waiting to happen. It had been in a state of neglect, its wear and tear allowed to worsen and deteriorate. Clamors for its restoration and development had fallen on deaf ears. According to official findings by AMH Philippines, Inc., a noted engineering firm, the building has generally very low residual strength for concrete and steel and would need retrofitting works. The main building is always flooded, while the extension building is in an advanced state of decay. The general structures are subject to high volume of seepage due to high pressure, undercurrent and its proximity to the Manila Bay. Estrada said that Oceanville Hotel & Spa Corporation has offered support for the project. “We hope that instead of criticizing, some sectors should join the effort and restore the landmark to its old original glory,” he added. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 Read More …

MANILA, Philippines – London-based Fitch Ratings has affirmed the credit ratings of rivals dominant carrier Philippine Long Distance Telephone Co. (PLDT) and Ayala-led Globe Telecom Inc. According to Fitch, it has affirmed PLDT’s Long-Term Foreign-Currency Issuer Default Rating (IDR) and senior unsecured rating at BBB. Likewise, the agency affirmed the Long-Term Local-Currency IDR and National Long-Term Rating at A- and AAA(phl), respectively, while outlook remained stable on all the issuer ratings. Fitch cited PLDT’s solid market position of a 57 percent revenue market share in mobile and broadband, and a 70 percent subscriber market share in fixed-line. Fitch expects PLDT’s operating EBITDAR margin to be 47 percent next year from 48 percent in 2013, higher than most regional peers thanks to the duopoly market structure and relatively benign competition and regulatory risks in the industry. “We expect operating EBITDAR margin to decline gradually by 100 basis points to 150 basis points each year over 2014-17 as lower-margin data services replace higher-margin traditional voice/text and long distance services,” the agency added. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 According to Fitch, competition is intense in the data segment because PLDT and Globe continue to provide handset subsidies and are only gradually migrating to volume-based tariffs from unlimited tariffs. “We forecast that PLDT will continue to lose 100bp of market share annually to Globe, which increased its mobile revenue market share to 43 percent from 34 percent during 2010-13,” it said. Fitch expects PLDT’s leverage to rise due to its Read More …