MANILA, Philippines – The peso moved sideways against the dollar on Tuesday, closing at 43.615 from the previous day’s 43.65. Total volume transacted at the Philippine Dealing System amounted to $732.25 million, higher than the $717.8 million posted on Monday. The peso opened Tuesday at 43.6.

MANILA, Philippines – A Mindanao-based legislator has filed a bill which seeks to increase the graveyard shift pay of Business Process Outsourcing (BPO) employees from 10 percent to 25 percent of their basic salary. Maguindanao Rep. Zajid Mangudadatu said House Bill 4414 seeks to ensure that BPO employees are properly compensated for the risks they are exposed to in working from 10 p.m. to 6 a.m. “BPO employees are often exposed to stress because they take calls of agitated or angry customers. They likewise make calls to customers of their companies for purposes of addressing concerns, making sales or other matters that require a lot of activity, resulting in undue stress. “In addition, most BPOs operate during the night and this adds to the employees’ exposure to health hazard,” Mangudadatu said. He said that he is optimistic BPO owners and operators can afford the additional graveyard shift pay for their employees. “It should be highlighted that BPOs are owned and operated by foreigners and are in Philippine Economic Zone Authority-accredited locations. This proposed increase is just a small price to pay for owners and operators of BPOs, some of whom enjoy tax benefits for being located in PEZA-accredited locations,” Mangudadatu said. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 He noted that the existing applicable provision in the Labor Code of the Philippines only mandates an additional pay of 10 percent for work done from 10 p.m. to 6 a.m. His bill, however, proposes that all BPO employees shall Read More …

MANILA, Philippines – JG Summit Holdings Inc. is increasing its capital spending by nearly a quarter to P44 billion this year to support key initiatives of its operating units. Core earnings of the conglomerate are projected to grow by double-digit this year on the back of continued expansion of its property, snacks and petrochemical businesses, and higher dividend income from investments in power generation and telecommunications, its top executive said. JG Summit president and chief operating officer Lance Y. Gokongwei said the P44.2-billion capital spending will drive the growth of the company this year. The amount was 23 percent higher than the P35.9 billion spent in 2013. Of the total, P16 billion will go to Robinsons Land Corp. (RLC), P14.1 billion for budget carrier Cebu Air Inc., P9 billion for snacks and beverage giant Universal Robina Corp. (URC), P5 billion for JG Summit Petrochemicals Corp. and P100 million for Robinsons Bank Corp. “The economy is growing very well and we’d like to participate in that (through) food, property, chemicals, bank and airline,” Gokongwei said. In particular, URC will commission a creamer factory in Vietnam and a bioethanol facility in the Philippines. It will also complete the construction of a factory in central Vietnam while improving its selling systems in Indonesia and Thailand. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 RLC, for its part, has opened five malls in fiscal year ending September 2014 while two more are in the construction stage. It will also launch P6 billion to Read More …

Some months ago before it was publicly announced, Ramon Ang told me he intended to buy a minority position in GMA 7. It was said in passing over lunch while we were talking about other things. I couldn’t dismiss it as just another item in RSA’s shopping spree. I had to ask him the most obvious question. Why? It made sense for MVP to want GMA 7 but RSA himself said a long time ago that owning media is just a headache. What made him change his mind? His answer was quick: content. He said he was buying GMA 7 because content is now the name of the game. What he said is true and I expressed the suspicion he was listening to too many speeches of MVP and Gabby Lopez. Both have been saying “content is king” for years now. Not so. RSA said he finds time to read the latest business magazines and journals. He said he gets a lot of ideas from his readings, including how to provide passengers of Philippine Airlines a state of the art entertainment system without costing them or the airline an arm and a leg. Still, there didn’t seem to be any obvious synergy for GMA 7 with the conglomerate he has assembled so far for San Miguel. I knew he owned some personal interest in Solar News but GMA 7 requires a lot more serious money. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 So I asked him where he Read More …

MANILA, Philippines – Manila Electric Co. (Meralco), the country’s biggest power distributor, has extended the interim power supply agreements it entered into with independent power producers, a ranking official said. This is on the back of the tight supply situation in the Luzon Grid. Meralco senior vice-president and head of Customer Retail Services Al Panlilio said that the power distributor extended three agreements until July and October. “Global Business Power and 1590 extended from July 1 to October 31 2014. Also, Panasia is extended until July 31 2014,” Panlilio said. Meralco has signed power supply agreements that could provide up to 204 megawatts in much needed additional capacity from April to June 30 as part of efforts to help lessen the company’s exposure to volatile prices at the Wholesale Electricity Spot Market (WESM). WESM is the country’s trading floor for electricity. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 Meralco had signed separate agreements with Global Business Power’s Toledo Power Co. for up to 28 MW and an option for additional 9 MW and with Panay Power Corp. for up to 27 MW both covering the period April 1 to June 30. It also signed agreements with 1590 Energy Corp. for up to 140 MW in capacity and associated energy output from its 225-MW Bauang Power Plant in La Union and with PanAsia Energy Inc. for the purchase of up to a maximum capacity of 270 megawatts (MW) from April to June. Furthermore, Meralco is also supporting Interruptible Load Program (ILP) Read More …

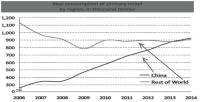

In a previous article, we have written about how the Philippines is blessed in many different ways (see There’s More in the Philippines, 13 January 2014). We pointed out the many good things in our country, such as the strong GDP growth brought about by OFW remittances and BPOs because of the unique talent and personality of the Filipino. We also cited the reforms that were instituted and PNoy’s focus on governance, which created a secular bull market for stocks. For this article though, we will put the spotlight on one of our country’s biggest blessings – mineral resources. More minerals in the Philippines In order to highlight our natural resources, we came out with a series of articles about our country’s main metal exports (see What is Nickel?, 22 November 2010, The ‘Red Metal’, 29 November 2010, and Gold Sparkles, 13 December 2010). Although these were written more than 3 years ago, the fact remains that much of our country’s wealth remains underground. According to the DENR, the Philippines is ranked as the 5th most mineralized country in the world. Rich in many metals, research firms have estimated that our total mineral reserves amount to as much as US$1.5 trillion – more than 5x our total GDP! The unique Philippine nickel situation Although the Philippines is known for being rich in gold and copper, it is also rich in another mineral – nickel. Nickel’s main characteristic is its high melting point and exceptional resistance to corrosion, making it a Read More …

MANILA, Philippines – The government will sell 10-year bonds for the first time in a year as part of its P135 billion domestic borrowing program for the third quarter. The Bureau of Treasury has kept its domestic borrowing ceiling at P135 billion given its strong liquidity position. Under the plan, the government will sell P20 billion worth of 91-, 182- and 364-day Treasury bills per month from July to September. The Treasury bill auctions will be held on July 9, Aug. 6 and Sept.r 3. The government will offer P25 billion worth of seven, 10 and 20-year Treasury bonds on July 24, Aug. 20 and Sept. 18, respectively. For this year, the Aquino administration has programmed to borrow P715 billion, of which P620 billion will come from the domestic market. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 The government’s program for the borrowing mix for 2014 is 85 percent for domestic and 15 percent for foreign. The government regularly holds auctions of securities to help fund the country’s budget and provide investors with fresh investment options. The Aquino administration will continue to rely more on domestic sources than on foreign creditors to avoid substantial exposure to foreign exchange risks. The government borrows funds to pay maturing obligations and plug the deficit in its budget. The country relied heavily on domestic borrowings last year to capitalize on the local financial system’s strong liquidity and help ward off pressures on the exchange rate. Foreign borrowing was limited to loans from Read More …

MANILA, Philippines – Listed Macay Holdings Inc., led by former ambassador Alfredo Yao, is infusing more than P2 billion into subsidiary ARC Refreshment Corp., the sole Philippine bottler and distributor of RC Cola. In a disclosure, the company said its board approved the plan to secure P2.08 billion worth of shares in ARC Refreshments. Proceeds from the transaction will “finance the acquisition of machinery, equipment, and other assets to be used in ARC Refreshments’ bottling operations,” Macay Holdings said. Last week, ARC Refreshments announced its plan to acquire two plants of Zest-O Corp., also owned by Yao. ARC is a Filipino-owned company engaged in the beverage business. It has the exclusive license to manufacture and distribute RC Cola, Fruit Soda Orange, Juicy Lemon and Arcy’s Rootbeer. In December, the board of Macay Holdings approved the acquisition plans of newly-created subsidiary ARC Refreshment. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 The board approved the plan to acquire “all the operating assets of Mega Asia Bottling Corp. consisting of Mega Asia and such other assets deemed necessary for bottling operations.” In September, Mazy’s Capital Inc. bought Maybank Kim Eng Holdings Ltd.’s (MKEHL) entire 89.75-percent stake in Maybank ATR Kim Eng Financial Corp. for P3.19 billion. Mazy’s Capital purchased 958.923 million MAKE shares at P3.3298 apiece. Unlisted holding firm Mazy’s Capital is owned by Zest-O Corp. (57 percent) and Mega Asia (43 percent). MAKE was previously a shell company following MKEHL’s move to consolidate all its assets into Maybank ATR Kim Read More …

Famous American comedienne Lily Tomlin says: “Ninety-eight percent of the adults in this country are decent, hard-working, honest Americans. It’s the other lousy two percent that get all the publicity. But then, we elected them.” Why do some politicians have such bad reputations? Maybe because they are good at one thing; making promises that never come true. When the campaign season starts, the same promises will be offered –yet again. In many cases, the campaigns already started and I thought that candidates are not supposed to campaign unless given the official go-signal by the government. But then, this is the Philippines. As long as what you do is not illegal (find the law loopholes, look at the law gaps, we have a battalion of lawyers who are experts in this area) never mind the moral implications. Just follow the letter of the law and forget the spirit of the law. And these people might be our next leaders in government. Promises, more promises, and even more promises. Suddenly we see these politicians as champions of the masses. And the masses are suddenly visible in their political radars. They give the masses empty hopes and assurance until election day. Isn’t it amazing how this game is played over and over? After the election, only promises remain, and the masses are left hanging. The loop is never closed. It’s frustrating. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 But do you know that the same principle happens in business? Did you Read More …

MANILA, Philippines – With the clamor of many board directors to equip themselves with the right skills and knowledge to be effective in their roles in strengthening the corporate governance of their organizations, the Center for Global Best Practices (CGBP) has launched a series of effectiveness programs to address their needs: (1) Best Practices for Audit Committees, Wednesday and Thursday, July 9 & 10. This is a requirement for publicly listed firms; (2) “Best Practices In Corporate Housekeeping: The Experts’ Guide On How to Be An Effective Corporate Secretary” on Thursday and Friday, Aug. 7 & 8; (3) Best Practices in Enterprise Risk Management, Aug. 27 (also required for publicly-listed businesses); and (4) Board Director’s Guide on Corporate Governance and Updates, Feb. 19. The venues for these special programs will be at the Edsa Shangri-La hotel, Mandaluyong City, Philippines. Attending these programs will be most useful for board directors, board chairperson, vice chairperson, corporate secretaries and assistant corporate secretaries. These are SEC-mandated programs to strengthen your organization’s governance and specially required for those board directors of publicly listed firms or are planning to seek a board seat or appointment as a director in the board. The program on corporate housekeeping seminar would be also be of special benefit to, among others, corporations, business owners, directors, and management who may want to know how best to use the services of the corporate secretary; new lawyers who may wish to learn the best practices in corporate housekeeping; older lawyers who may want Read More …