MANILA, Philippines – Property giant Ayala Land Inc. (ALI) likely continued growing its profits in the first quarter on the back of strong performance across all business segments. New properties like malls, offices and hotels launched last year will start contributing profits in the next few months, an official said. “(Performance) is still good. It’s a respectable quarter, still consistent with expectations,” said ALI chief finance officer Jaime E. Ysmael. “We were firing on all engines effectively. All different businesses continue to contribute to the pie,” Ysmael said. The property arm of the Ayala conglomerate posted a 30-percent jump in profits to P2.76 billion in the first three months of 2013 from P2.13 billion a year ago. Consolidated revenues hit P18.53 billion, up 38 percent from the P13.39 billion. Ysmael said the country’s property sector remained robust, allowing the residential segment to remain as the biggest contributor to ALI’s earnings in the first quarter of the year. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 “We did not launch that many projects in the first quarter. But the succeeding quarters is when most of the projects will happen,” Ysmael said. ALI plans to launch 78 projects consisting of 30,000 residential units this year with an estimated value of P142 billion. The five residential brands of the property firm launched a total of 28,482 units worth P108 billion last year. ALI is primarily into the development of residential projects, lease of commercial and office space and sale of prime lots. Read More …

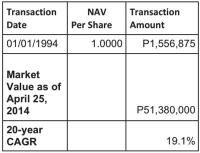

In our article four weeks ago, we showed how people can profit from the Peso Cost Averaging method (Example of a Real-Life Investor, March 31, 2014). We recounted the inspiring story of an actual investor of the Philequity Fund who invested P5,000 to P10,000 on a weekly basis. In our article today, however, we show the ledger of another investor who employed a different style of investing but still made a lot of money. Recalling the peso cost averaging method Like we discussed previously, Peso Cost Averaging is an investing technique which involves buying a fixed peso amount of stocks on a regular schedule. As we showed during our March 8 Investors’ Briefing and in our article last March 31, this method is a stress-free way of investing. This is because it allows people to grow their investment position gradually instead of committing a large sum all in one go. One time, big time Let us now look at the statement of account of another investor that we presented during our Investors’ Briefing. As you can see, he invested P1.56 million back in 1994 (when the Philequity Fund began). He has neither withdrawn from nor added to his investment since. Today, his lump sum or “one-time-big-time” investment has grown to over P51 million! This translates to a CAGR of 19 percent for the past 20 years. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 Time to grow What can we gather from this investor’s experience? It is the significance Read More …

MACTAN, Cebu , Philippines – The Bangko Sentral ng Pilipinas said it will not “hesitate” to deploy measures to prevent any asset price bubbles forming in the property sector amid sustained growth in real estate credit. Central bank Deputy Governor Diwa C. Guinigundo, during the annual BSP Lecture Series, said the above 20-percent increase in loans to real estate in the three years to 2013 bears “closer monitoring.” “Today, while there is no evidence of overstretching of asset prices as far as real estate sector is concerned, if you will have over 20 percent, 30 percent, or 25-percent (credit) growth, it also comes to a point when it becomes risky,” Guinigundo said. The BSP official said that during the height of the global financial crisis in 2008, real estate credit growth hit 30.2 percent, but this sharply fell to 12.3 percent in 2009 and 12.2 percent in 2010. The figure climbed to 25.2 percent in 2011 and to 29.7 percent in 2012, before slightly easing to 22 percent last year. “If there is evidence that there are signs (of asset price inflation) then the BSP will not hesitate and we will undertake the necessary measures from the monetary policy side and the prudential side,” Guinigundo said. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 Real estate loans amounted to P831.787 billion last year, up from the P676.928 billion recorded in 2012. The increase was driven by a 24-percent expansion in commercial real estate borrowings to P511.337 billion and a Read More …

MANILA, Philippines – The country’s possible participation in the Trans-Pacific Partnership (TPP) agreement is expected to be part of the discussions in the visit of US President Barack Obama to the country today until Tuesday. In a statement, the American Chamber of Commerce of the Philippines said its members are hopeful the discussions between the leaders of the two countries will lead to enhanced economic and security relations. “In particular, we hope that the Philippines will be welcomed into the group of countries in the TPP at the earliest opportunity to help sustain high levels of economic growth needed for the Filipino people to enjoy better lives in future years,” the group said. The Makati Business Club (MBC) likewise expects the TPP to be among the economic issues to be discussed. “That’s probably something they can discuss. What are some of the reasons why we cannot go on board immediately and maybe look at how we can get in the next round of countries that will join,” MBC executive director Peter Perfecto told reporters. The TPP, currently being negotiated by the US and 11 other Pacific countries such as Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam, seeks to set high standards covering intellectual property, labor rights and environmental protection, in line with the creation of a free trade bloc which would represent more than half of global output and over 40 percent of world trade. Business ( Article MRec ), pagematch: 1, sectionmatch: Read More …

MANILA, Philippines – Philippine Dealing and Exchange Corp. (PDEx), the country’s trading platform for fixed income securities, will likely post a banner year for 2014 as more companies raise funds through the bond market. The amount of bonds to be listed this year in the PDEx is seen to eclipse the all-time high of P111 billion recorded in 2012, its top executive said. “Definitely we will reach the P100 billion level…this will be a record year,” said PDEx president and chief operating officer Cesar Crisol. He said the previous high of P111 billion posted in 2012 will be breached this year given local companies’ moves to tap the bond market. “Right now, the issuers go to the capital markets to be able to tap the liquidity. Investors are also looking for the corporate bonds that have a premium over government securities,” Crisol said. So far, seven issuers listed 12 series of bonds worth P89.8 billion in the PDEx. Major listings include the P30-billion bonds of JG Summit Holdings Inc. and P15 billion bonds of San Miguel Brewery Inc. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 In 2013, eight firms issued 16 series of long-term bonds totaling P83.5 billion. For the issuers, Crisol said raising funds from the bond market is an opportunity to ease up on the single borrowing limits with the banking system, which is facing changes due to the implementation of Basel III. Basel III introduces a complex package of reforms designed to improve the ability Read More …

MANILA, Philippines – The US Wheat Associates (USW) supports the Philippine government’s decision to impose provisional duty on flour imports from Turkey citing that such creates a level playing field. In a statement, the USW said it is pleased the Philippine government has decided to provide relief to flour millers in the form of a provisional anti-dumping duty on Turkish flour imports. “The government’s decision sends a clear signal that flour millers in the Philippines, employing Philippine workers, should be able to operate in an open and fair trade environment,” the group said. USW which works with American wheat farmers with millers and baking associations in the Philippines, supports competitive, open and fair trade environments. It noted that Turkey’s highly protected wheat and flour market and complex inward processing scheme has created disruptive incentives for the Turkish milling industry to dump flour in export markets. “The Philippine government was correct in investigating PAFMIL’s (Philippine Association of Flour Millers, Inc.) claim against Turkish flour dumping. It also correctly found strong justification to protect its flour milling industry. As a result, every stakeholder in this issue may now move forward together in the spirit of fair competition,” the group said. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 Last week, the Department of Agriculture (DA) issued an order imposing a provisional duty of 35 percent on hard flour used for making bread, 39.26 percent on biscuit bread, and 35.21 percent on soft flour used for pastries and cookies, on top of Read More …

MANILA, Philippines – International shipping lines are asking the government to identify areas near the North and South harbors where depots could be established to bring down additional costs brought about by the truck ban imposed by the city government of Manila. Patrick Ronas, president of the Association of International Shipping Lines (AISL), has asked the Philippine Ports Authority (PPA) to identify areas near the ports to put up new depots to allow cost efficiency in transporting cargoes. Ronas pointed out that there are several depots owned by private contractors and not by shippers. He said shipping lines have to convince private contractors to operate their depots for 24 hours to accommodate truckers returning their containers. According to him, there was a move by contractors to look for space in the North or South harbors as an alternative for locating the depots but the only problem would be the distance. At the recent transport and logistics summit, the private sector pushed the setting up of alternative depots to address congestion of cargoes. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 Exporting and importing firms as well as service providers of transport and logistics and allied services contributed to the drafting of the resolution which aims to attain a sustainable solution on removing barriers in cargo transport and customs procedures. Among the proposed measures include the creation of alternative depots, maximization of Batangas and Subic ports, the 24/7 operations by the customs agency, the removal of the truck ban, the Read More …

It was difficult enough for Pastor Todd Burpo to deliver his religious sermons before his regular Sunday crowd in hometown Imperial, Nebraska. It was even more difficult to wrestle with his conscience that teetered between right and wrong, especially when the issue involved his four-year-old son, Colton. The Burpos were a typical couple with their beliefs and biases in practically everything except religion. But when their son had to be rushed to the hospital, survived the difficult stomach operation and later started talking about God and Heaven during the time he was being operated on and had an out-of-body experience, the couple faced a different kind of challenge. As Colton recounted the details of his visit with God in Heaven, Todd and Sonja didn’t know how to deal with this turn of events. All these had been written by Todd Burpo and Lynn Vincent in Heaven is for Real: A Little Boy’s Astounding Story of his Trip to Heaven and Back. And this little piece of non-fiction, which won the best in its category from the New York Times bestsellers in 2010, has been turned into a movie. The process of converting book to film, however, is a more difficult challenge, since one has to be faithful to the book particularly since it is a true-to-life account and will be portraying actual people and events. In the movie, for instance, the couple awaiting the results of Colton’s operation separately find themselves praying to God. Sonja cannot accept the findings of Read More …

MANILA, Philippines – Listed property firm Vista Land & Lifescapes Inc. has completed its return to the bond market, raising $225 million in fresh capital to support debt payments and expansion projects. The real estate unit of the Villar family said it generated $350 million of demand from 44 offshore and institutional investor accounts in the first dollar-denominated bond offering from a Philippines corporate in 2014. “The success of the tender offer and new issue represents an important milestone for Vista Land in the active management of its capital structure,” Vista Land said. “Most importantly, the exercise achieved the Vista Land’s objectives of reducing interest expense, further diversifying its funding sources and increasing funding from offshore investors,” it added. In terms of geographic distribution, roughly 95 percent of the bonds were distributed in Asia and the rest was distributed in Europe. By investor type, 60 percent of the bonds were distributed to banks, 28 percent to fund and asset managers, and 12 percent to private banks, Vista Land said. Business ( Article MRec ), pagematch: 1, sectionmatch: 1 “This enabled Vista Land to price the new five-year issuance at a yield of 7.625 percent, representing a 12.5 basis points tightening from initial guidance of 7.75 percent,” the property firm said. The bonds of subsidiary VLL International Inc. will bear a fixed interest coupon of 7.45 percent per year, with interest payable semi-annually in arrears. HSBC acted as sole global coordinator, and with DBS Bank Ltd., acted as joint bookrunners and Read More …

MANILA, Philippines – Epicor Software Corp., a leading global provider of enterprise business solutions for manufacturing, distribution, retail, and services organizations, announced today that Passepartout Philippines Inc. has chosen the Epicor enterprise resource planning (ERP) suite to improve its custom hand-inlaid surface manufacturing business operations. Photo shows Ruben Evangelista (second from left), business unit head of Orion Solutions Inc. and Patrick Millerd, production & ERP manager of Passepartout Philippines Inc. shake hands signifying their partnership to enhance Passepartout’s manufacturing business. They are joined in the photo by Marvin M. de Leon, business development executive of Orion Solutions Inc; and Araceli Co, finance & admin manager of Passepartout Philippines Inc.