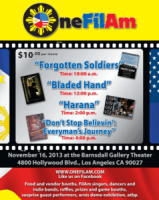

By: Alex Llorente LOS ANGELES, CA (September 26, 2013) – Filipino movie enthusiasts will be treated with an opportunity to see four critically acclaimed Filipino documentary films one after another at the OneFilAm Film Festival on Saturday November 16, 2013 at the Barnsdall Gallery Theater in Hollywood. The films, which were official entries to various film festivals, will showcase Filipino values, heritage and culture as portrayed through the lives of soldiers, martial artists and musicians. Forgotten Soldiers is a film about General Douglas MacArthur’s best soldiers and members of the U.S. Army’s Philippine Scouts in Bataan during World War II who were instrumental in preventing the invasion of Australia from the Imperial Japanese forces. It is a collection of personal accounts from some of the remaining veterans who survived the Bataan Death March, actual footage of the battles, reenactments, photographs and WWII memorabilia. Produced and directed by Donald Plata, written by Chris Schaefer and narrated by Lou Diamond Phillips. (www.ww2scouts.com) Showing at 10:00 a.m The Bladed Hand is a documentary on the global impact of the Filipino Martial Arts. It talks about the fighting methods and styles that were devised in the Philippines and the weapons used by early Filipino warriors and modern Martial Artists. From bolos (blade), arnis (wooden stick) and mano mano (bare hands), Filipinos have propagated various art forms of self-defense and made valuable contributions to tactical and combat practices around the world. Produced by Jay Ignacio. (www.twitter.com/thebladedhand) Showing at 12:00 p.m. Harana features three Filipino serenade Read More …